Содержание

- 2. Project background “Enzymes” category is one of the several Digestive Health markets – 35 mln packs

- 3. Research questions and core goal Core goal: To unlock switching trigger from mono-component competitors (Mezym, Pancreatin).

- 4. SALT research methodology Desk research Pharmacists Consumers Analysis Collect range of opinions in social networks and

- 5. 12 x 1h in-depth interview in Zoom Pharmacists 2 Methodology & Sample & Geography

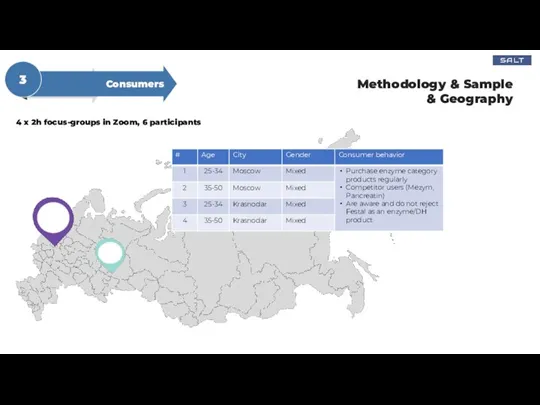

- 6. 4 x 2h focus-groups in Zoom, 6 participants Methodology & Sample & Geography Consumers 3

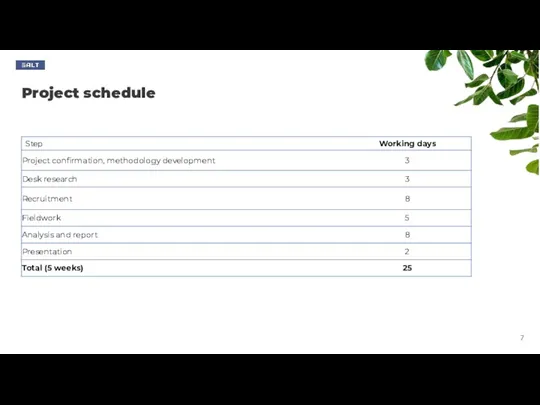

- 7. Project schedule

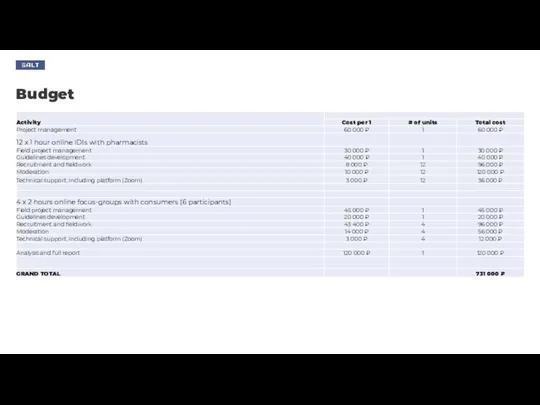

- 8. Budget

- 10. Скачать презентацию

Слайд 2Project background

“Enzymes” category is one of the several Digestive Health markets –

Project background

“Enzymes” category is one of the several Digestive Health markets –

TOP players of the category: Kreon (MS 33% in value; 12% in volume), Festal (18% in value; 14% in volume), Mezym (16% in value; 22% in volume) and list of generic Pancreatins (9% in value; 37% in volume).

Festal is a traditional medicine (>30 years on the Russian market), #2 in brand awareness, #3 in pharmacists’ recommendation (after Kreon and Mezym). Festal has 3 component composition with 2 additional ingredients which gives us superiority vs other mono-component players.

Festal range consists of 4 SKUs with defined strategic role for each one:

- #10 Switching driver/Trial format (launched a year ago) - a subject of the research

- #20 Volume driver

- #40 Hero SKU, sales generator

- #100 Value for money format

Key brand source of growth: switch from cheap competitors via new affordable #10 format.

One year after the launch – there is still low level of sales, pharmacists don’t recommend this SKU instead of cheap competitors. There is a hypothesis that pharmacists don’t see any value in this SKU neither for recommendation nor for profitability.

From the brief

Слайд 3Research questions and

core goal

Core goal:

To unlock switching trigger from mono-component competitors

Research questions and

core goal

Core goal:

To unlock switching trigger from mono-component competitors

Research questions

How the pharmacists see their role in DH category, especially related to indigestion symptoms – sales, consulters, active switchers etc

What are their strategies for switching consumers (when, whom and how), what can trigger this switching behavior. What are the best cases they see on the market in switching consumers? What is the role of different packaging on the market? How they define the role of the different sizes, formats?

How they define Festal portfolio, what is the role of each of the SKU

Festal #10 current role inside Festal range and in Enzymes category as well

What are the barriers and triggers for Festal #10 among Pharmacists

Strengths and weaknesses of Festal #10 format

Why Festal #100 is preferable to sell by blisters and there is no value to recommend #10 as a finished good

Consumer portrait of Festal #10 and Festal #20: is there any cannibalization or not

Is the price difference between Mezym #20 and Festal #10 enough to increase average pharmacy receipt and/or to get more margin

What kind of arguments we should deliver with MedReps to accelerate #10 sales

The right messages for Festal differentiating from other enzymes

From the brief

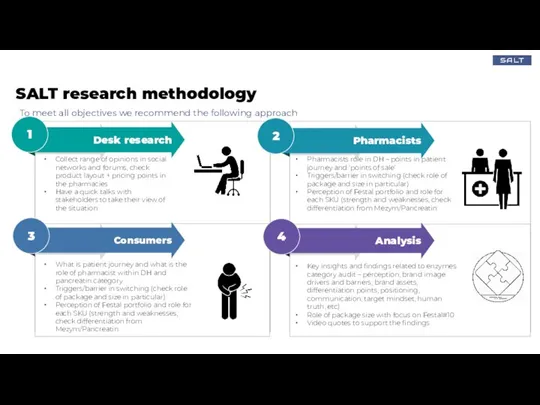

Слайд 4SALT research methodology

Desk research

Pharmacists

Consumers

Analysis

Collect range of opinions in social networks and forums,

SALT research methodology

Desk research

Pharmacists

Consumers

Analysis

Collect range of opinions in social networks and forums,

Have a quick talks with stakeholders to take their view of the situation

Pharmacists role in DH – points in patient journey and ‘points of sale’

Triggers/barrier in switching (check role of package and size in particular)

Perception of Festal portfolio and role for each SKU (strength and weaknesses, check differentiation from Mezym/Pancreatin

What is patient journey and what is the role of pharmacist within DH and pancreatin category

Triggers/barrier in switching (check role of package and size in particular)

Perception of Festal portfolio and role for each SKU (strength and weaknesses, check differentiation from Mezym/Pancreatin

1

3

To meet all objectives we recommend the following approach

2

4

Key insights and findings related to enzymes category audit – perception, brand image drivers and barriers, brand assets, differentiation points, positioning, communication, target mindset, human truth, etc)

Role of package size with focus on Festal#10

Video quotes to support the findings

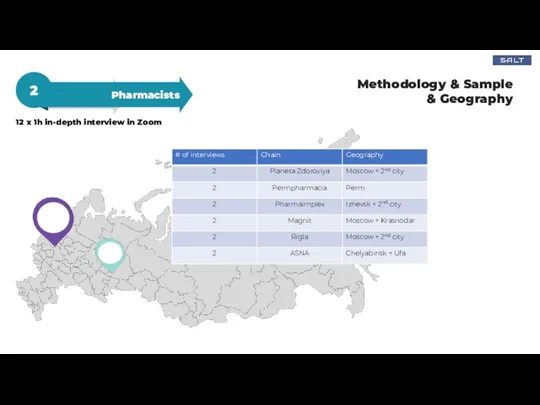

Слайд 512 x 1h in-depth interview in Zoom

Pharmacists

2

Methodology & Sample & Geography

12 x 1h in-depth interview in Zoom

Pharmacists

2

Methodology & Sample & Geography

Слайд 64 x 2h focus-groups in Zoom, 6 participants

Methodology & Sample & Geography

Consumers

3

4 x 2h focus-groups in Zoom, 6 participants

Methodology & Sample & Geography

Consumers

3

Слайд 7Project schedule

Project schedule

Слайд 8Budget

Budget

Система здравоохранения. Направления по оказанию первой медицинской помощи

Система здравоохранения. Направления по оказанию первой медицинской помощи Холестеатома наружного слухового прохода

Холестеатома наружного слухового прохода Пренатальная диагностика в Челябинской области. Реалии и перспективы

Пренатальная диагностика в Челябинской области. Реалии и перспективы Безопасность сестринской деятелньности

Безопасность сестринской деятелньности :Атопилық дерматитпен балаларды диспансеризациялау және сауықтыру

:Атопилық дерматитпен балаларды диспансеризациялау және сауықтыру Заманауи инсулиндік терапия

Заманауи инсулиндік терапия Хирургич. заболевания печени

Хирургич. заболевания печени МКБ NEW коротко

МКБ NEW коротко Кишечный шов

Кишечный шов Медицинский центр МедКом-Профи

Медицинский центр МедКом-Профи Ішкі аурулар

Ішкі аурулар Глаукома. Симптомы глаукомы. Лечение

Глаукома. Симптомы глаукомы. Лечение Клиническая анатомия и физиология глотки

Клиническая анатомия и физиология глотки Рациональное питание беременных

Рациональное питание беременных Внедрение дистанционного описания суточного мониторирования ЭКГ в Челябинской области

Внедрение дистанционного описания суточного мониторирования ЭКГ в Челябинской области Жизнь современного ребенка. Интенсивный рост. Школьные нагрузки. Стрессы

Жизнь современного ребенка. Интенсивный рост. Школьные нагрузки. Стрессы Первая медицинская помощь при обморожении

Первая медицинская помощь при обморожении Реанимация новорожденных

Реанимация новорожденных Выявление РНК Коронавируса Covid-19

Выявление РНК Коронавируса Covid-19 Специфическая профилактика COVID-19. Вакцинация беременных

Специфическая профилактика COVID-19. Вакцинация беременных Теоретическое обоснование технологии Plasmolifting™

Теоретическое обоснование технологии Plasmolifting™ Гимнастические упражнения как средство укрепления правильной осанки у детей дошкольного возраста

Гимнастические упражнения как средство укрепления правильной осанки у детей дошкольного возраста Желчнокаменная болезнь (ЖКБ)

Желчнокаменная болезнь (ЖКБ) Кандидоз полости рта у детей

Кандидоз полости рта у детей Принципы лечения наследственных болезней, реабилитации и социальной адаптации больных

Принципы лечения наследственных болезней, реабилитации и социальной адаптации больных Неотложная помощь при утоплении

Неотложная помощь при утоплении Болезни, вызываемые нарушением регуляции экспрессии генов

Болезни, вызываемые нарушением регуляции экспрессии генов Основные препараты, применяемые при хроническом холецистите

Основные препараты, применяемые при хроническом холецистите