Содержание

- 2. Introduction. Everyone in the World should make a very important choice of this life. He must

- 3. About banking. Activities of banks. Banks, being the major financial institutions, function, develop and influence the

- 4. Structure of the bank The structure of the bank - this is a very large system

- 5. Operations Department. Work teller (accountant, expert) serving individuals are as follows: Registration and issuance of deposits,

- 6. Operations Department. Work teller (accountant, expert) service entities are as follows: Receiving and checking accounting documents

- 7. Cash transactions Department. Operations Division produces cash services, i.e. receive and disburse cash. Employees who work

- 8. Credit Department. Working in a bank in the credit department is not just credit, and complex

- 9. Department of Securities. The specialists of the department engaged in operations of the bank associated with

- 10. Foreign exchange department. All operations of the bank in foreign currency carried out by experts of

- 11. Financial Monitoring Department. This is a very serious structure of the bank. The aim - to

- 12. Law Department. This department is staffed with experts who have only a law education. The lawyer

- 13. Accounting department. The main task of the staff of this department is the proper and timely

- 14. Sales department. Here is a manager in various versions (manager, Customer Service, Manager, customer acquisition, etc.).

- 16. Скачать презентацию

Реклама на сайте Хабрахабр для украинских рекламодателей

Реклама на сайте Хабрахабр для украинских рекламодателей Open InfoSec Days

Open InfoSec Days Кроссворд. Лен

Кроссворд. Лен Армия Казахстана

Армия Казахстана Вставка музыки в презентацию

Вставка музыки в презентацию Внутренняя среда организма. Плазма крови

Внутренняя среда организма. Плазма крови Тракторист-машинист сельскохозяйственного производства

Тракторист-машинист сельскохозяйственного производства 20170406_ikt_na_geografii

20170406_ikt_na_geografii Евреи и нееврейская еда: законы и практика

Евреи и нееврейская еда: законы и практика Благотворительная

Благотворительная Портрет моего целевого клиента

Портрет моего целевого клиента Презентация на тему Стихийные явления в гидросфере

Презентация на тему Стихийные явления в гидросфере TMN - Telecommunication Management Network

TMN - Telecommunication Management Network Перенос слов (1 класс)

Перенос слов (1 класс) Коррозия железа в различных средах

Коррозия железа в различных средах Изучение типологических особенностей спортсменов разной специализации

Изучение типологических особенностей спортсменов разной специализации Философия субъектности как основа психологической практики

Философия субъектности как основа психологической практики Презентация на тему Эдуард Мане

Презентация на тему Эдуард Мане  Математическая викторина

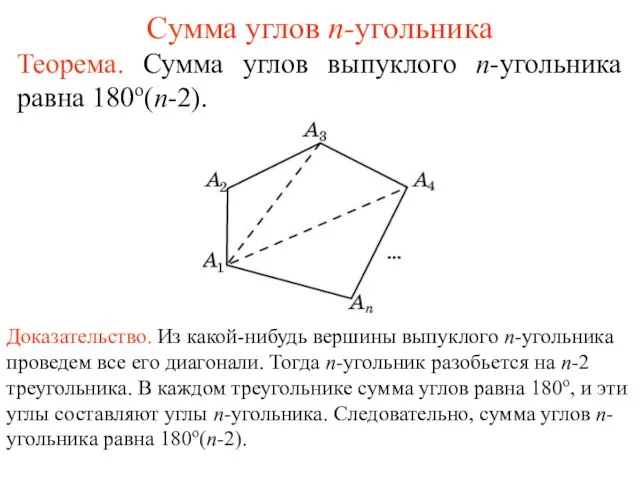

Математическая викторина Презентация на тему Сумма углов n-угольника

Презентация на тему Сумма углов n-угольника  Холодильная перевозка, контейнер

Холодильная перевозка, контейнер Применение тригонометрических формул в вычислениях и тождественных преобразованиях

Применение тригонометрических формул в вычислениях и тождественных преобразованиях Процессуальные риски

Процессуальные риски Оксфорд Класс. English для успешных людей

Оксфорд Класс. English для успешных людей Новософт

Новософт Презентация на тему Информационная сеть

Презентация на тему Информационная сеть Современные инструменты для формирования портфелей с ограничением убытков

Современные инструменты для формирования портфелей с ограничением убытков Политические партии России

Политические партии России